Today’s Market Summarised

Reliance continues to pull down the market as banks show strength.

NIFTY opened with a small gap-down at 16,257. The index shot up initially and then cooled back down. Towards 1 PM, resistance was taken and a fresh day-low was created towards closing time. NIFTY ended the day at 16,240, down by 62 points or 0.38%.

BANK NIFTY started the day at 34,244 and shot up 200 points in 5 minutes. The index took resistance at 34,800 and fell nearly 400 points towards the closing time. BANK NIFTY ended the day at 34,482, up by 207 points or 0.60%.

NIFTY METAL(-5.20%) and NIFTY REALTY(-2.94%) crashed once again. Pharma(-1.48%) and IT(-1%) sectors also fell.

Asian markets mostly closed in the red. European markets are up in the green currently.

Today’s Moves

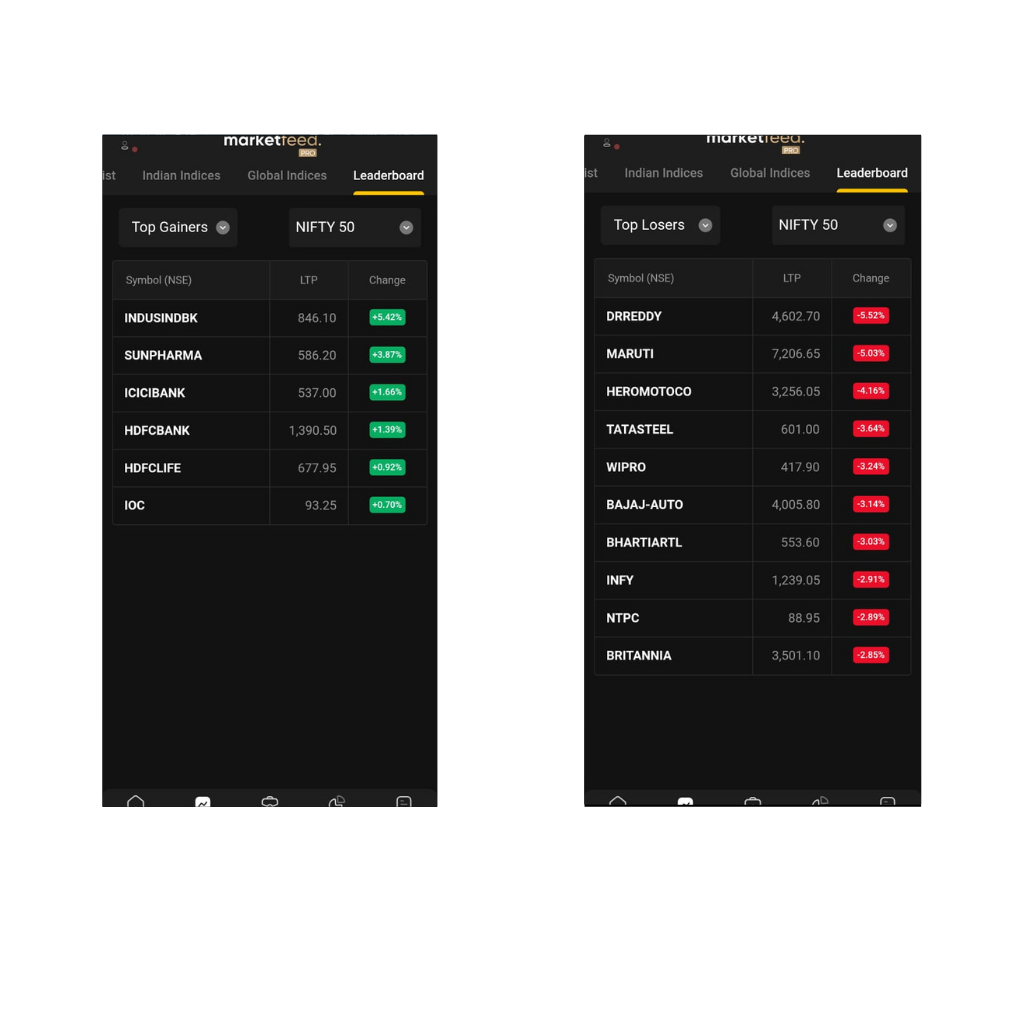

Eicher Motors(+3.04%) closed as the top-gainer in NIFTY 50 after a 6 trading day fall. Hindustan Unilever(+3.01%) also bounced back.

Asian Paints(+2.70%) moved up after announcing flat Q4 net profits growth at Rs 874 crores.

Energy stocks crashed along with global stocks as international energy prices dived. US Oil prices fell 8% in 2 days. Coal India(-7.10%), ONGC(-6.25%), Reliance(-1.73%) and NTPC(-2.23%) were among the top-losers in NIFTY 50.

Other commodity prices also fell internationally and our stocks reacted. Tata Steel(-6.98%), JSW Steel(-4.87%) and Hindalco(-4.75%) fell from NIFTY 50.

National Aluminium(-6.68%), Jindal Steel(-6.58%) and Vedanta(-5.65%) were other metal stocks which crashed.

Kotak Bank(+1.68%) is testing and breaking a downtrend. We may see a good breakout in the coming weeks if Bank Nifty supports.

Markets Ahead

It is worth noting that Metals have fallen significantly. This makes the fall more than 15% from the high. International metal and realty stocks have been falling after the interest rate hike are expected to cause a fall in housing demand.

Rupee falling to the lowest did hurt the market sentiments that led to the heavy selling in the last hour. India’s Consumer Price Inflation data will be a crucial event in this scenario. The data is expected to be out on Thursday. Also, we have U.S. CPI to be released tomorrow evening.

Now that the interest rate hikes have started based on a certain targeted inflation rate, this data would affect the market.

The European markets are sustaining the initial gains of the day along with the positivity in the US futures.

For NIFTY, 16,400 has again proven its strength as a resistance level. Our markets have closed at the intraday low and it will be interesting to see if the US closes in the green and might cause a gap-up tomorrow for us. In that case, traders who shorted the market towards the end seeing the weak close will suffer a setback, just like what we have been seeing for the last month.

Let us closely watch 16,000 on the downside if the fall continues. Reliance showing bearishness as international energy prices fall is expected. So do expect this bearishness for NIFTY, as well.

See you all today at 7 PM on The Stock Market Show.