Today’s Market Summarised

Nifty opened the day with a small gap-up at 14,772 and tried to move up. Most sectors kept moving up and down systematically to make sure that Nifty had no violent moves. Even with the loan moratorium case judgement being announced, Nifty closed the day at 14,814, up 78 points or 0.53% in the day.

Bank Nifty opened the day at 33,757 and was generally bullish in the day. It consolidated till the moratorium announcement and then shot up more than 500 points in a 10 minute gap. Profit booking kicked in and the index fell almost 700 points just after this. Bank Nifty went up slowly up over the day to close at 34,184, up 580 points or 1.73%. Bank Nifty took resistance at last Friday’s high. Will we see a breakout?

Nifty PSU Bank was up nearly 3% in the day. Bank Nifty(up 1.73%) and Nifty Realty(up 1%) closed more than 1% up. No other sector moved more than 1% in the day.

Most European and Asian Markets are currently trading in the red.

News Picks

Pfizer India shares jump up 2% after health ministry official said the country is also considering Pfizer vaccine.

Allana Group, popular for their FMCG products like ice-cream London Dairy, picked up 1% stake in LT Foods. LT Foods shares were up more than 4% in the day.

Adani Ports jumped up further in the day, and closed up 2%. The company announced in a regulatory filing today that it will acquire 58% stake in Gangavaram Port for ₹3,604 crore. With this, they hold near 89% stake in the Andhra port.

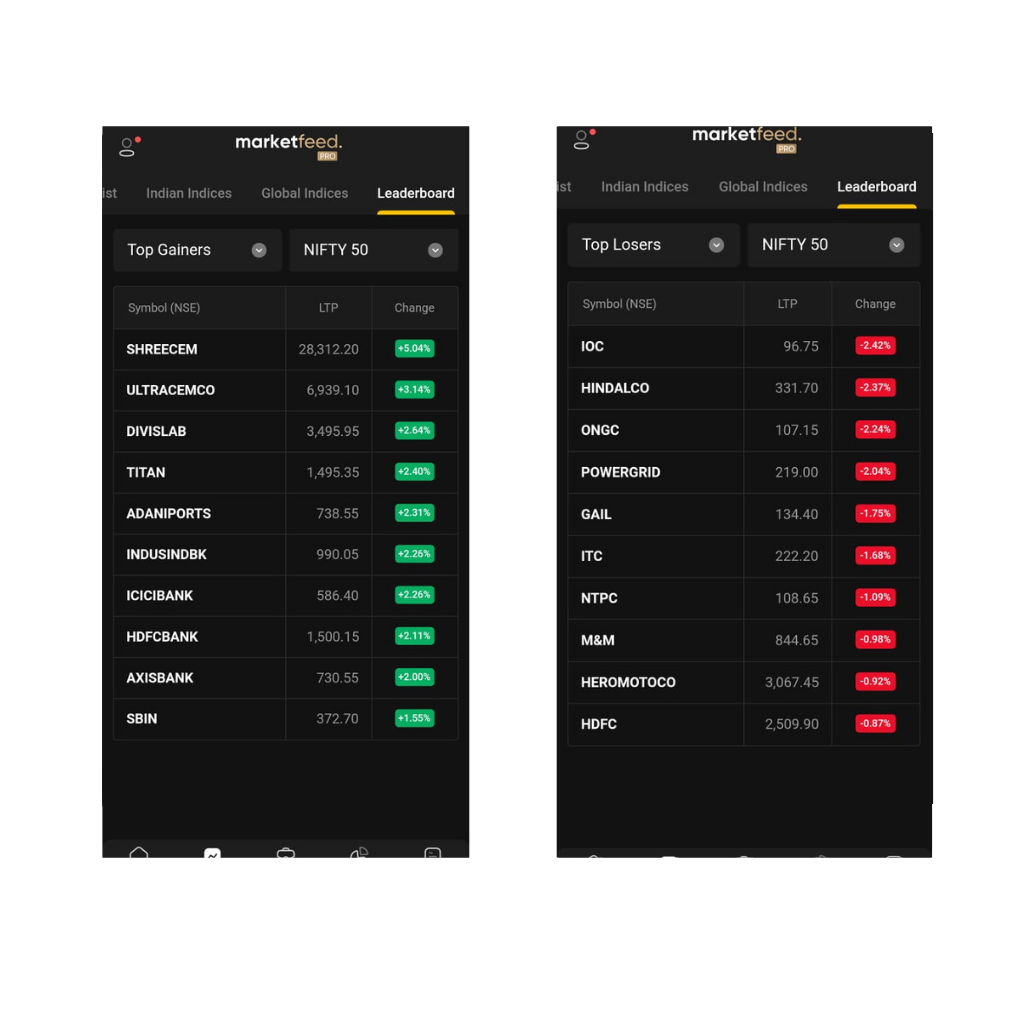

Cement companies rose in the day with Shree Cements(up 5.04%), UltraCement(up 3.14%) and Ambuja Cements(up 3%). Mines and Minerals (Development and Regulation) Amendment Bill passed yesterday will benefit mines and cement companies according to analysts. This could be why Adani Enterprises was up nearly 7% as well.

Banking shares went up in the day, HDFC Bank and ICICI Bank pushed up the bank index today. Bank Nifty was up more than 1.7% in the day after the court said a waiver of complete interest is not possible. Left the decision to RBI and Government.

5 out of the top 10 losers in the day on Nifty 50 were public sector companies. IOC, ONGC, and GAIL fell between 1.5-2.5% in the day.

Dixon Technologies fell another 4.5% in the day after the companies share split was completed yesterday. Even yesterday, the stock had fallen 4-5% in the day.

Realty stocks went up in the day, with the index going up nearly 1%. Prestige, DLF and Godrej Properties were up in the day.

IDBI Bank share went up nearly 7% in the day to consider and approve the proposal for approval of bond borrowings limit of Rs 8,000 crore for the next financial year.

Markets Ahead

Banks got renewed power in the day as Supreme Court finally announced its verdict on the Loan Moratorium case. But with SC lifting the stay on classification of NPAs, banks are expected to report worse asset quality in the current quarter. Interest on interest on these loans will be more than Rs 7,000 crore, as predicted by ICRA.

Only Kotak Mahindra Bank closed in the red from Bank Nifty. Hopefully this power is sustained.

It is the close of the financial year and earnings season will kick of next month with IT companies reporting as always. TCS hiking salaries for all its employees from April can be a sign of a good result in the company once again. IT stocks can be watched ahead of the results.

With Thursday being the weekly and monthly expiry, we could see some high volatility in the coming two days. Especially since Nifty has been consolidating. Watching to catch some good moves tomorrow in the index.

Reliance could not cross 2,110 today, and HDFC consolidated and closed in the red. Keeping these two stocks in my personal watchlist for tomorrow, you can too!

Also, anyone above the age of 45 can get a Covid-19 vaccine in India from April 1.

Catch you all on The Stock Market Show tonight!