Today’s Market Summarised

A very calm Thursday which was expected to be filled with fireworks!

NIFTY opened the day at 18,258 with a slight gap-up. From the start, it was a volatile day for the index. The initial resistance of 18,270 was respected throughout the day. NIFTY ended the day at 18,257, up 45 points or 0.25%.

BANK NIFTY opened the day at 38,691 with a slight gap-down and remained in red throughout the day. The index broke the support at 36,500 but traded around that zone. Bank Nifty ended the day at 38,469, down 257 points or 0.67%.

NIFTY METAL (+3.4%) outperformed on the day along with NIFTY Pharma (+1.5%). All other indices consolidated.

Asian markets closed mixed in the day. European markets are currently trading in the red.

News Picks

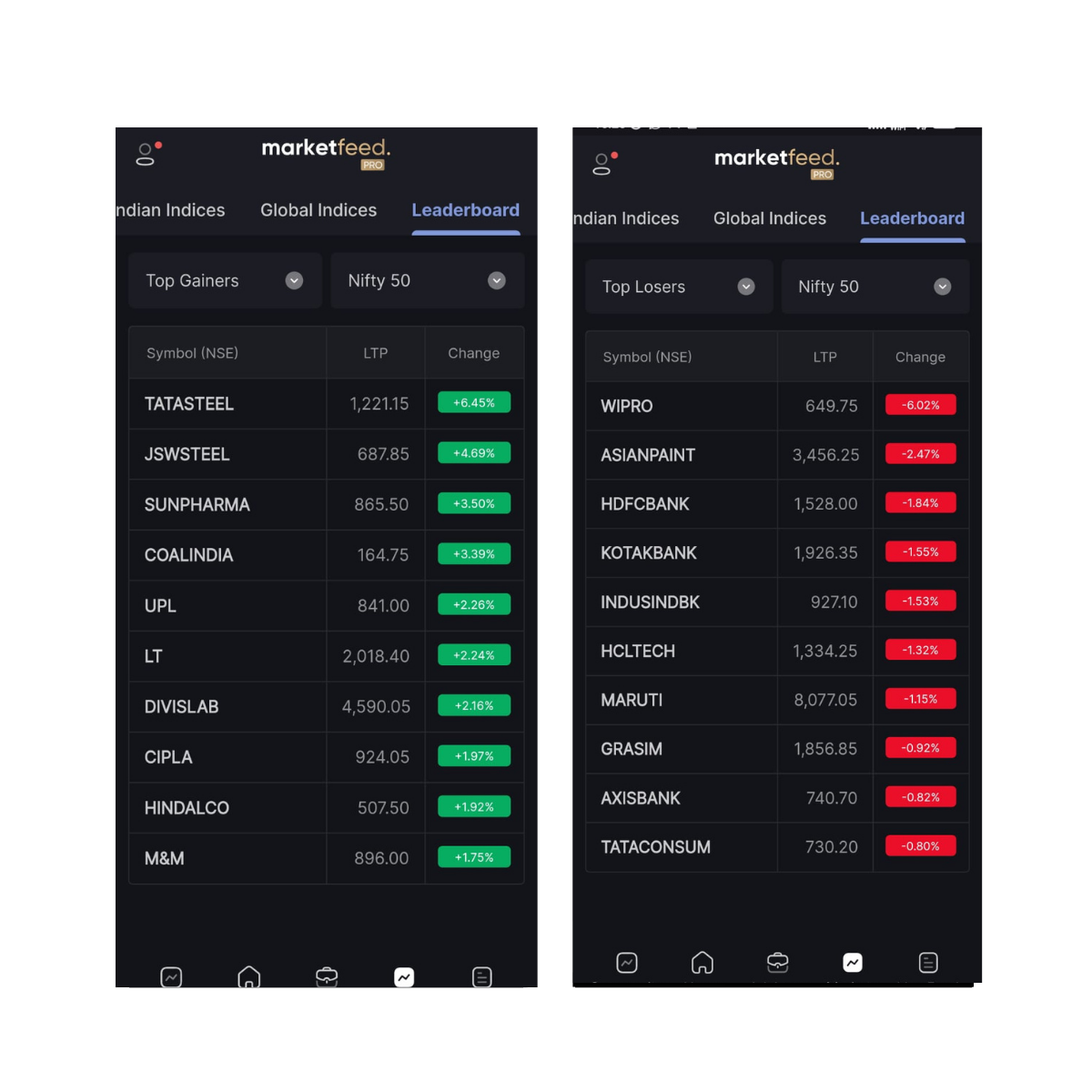

Tata Steel (+6.4%), JSW Steel (+4.6%), Coal India (+3.3%) and Hindalco (+1.9%) moved up from the NIFTY Metal index. Jindal Steel (+5.8%), NMDC (+3.3%) and SAIL (+2.9%) also moved up.

SunPharma (+3.5%) hit nearly a 5-year high and closed in the top-gainers of NIFTY 50 along with Cipla (+1.9%) and Divi’s Lab (+2.1%).

Wipro (-6%) opened with a gap-down and fell again. The stock closed as NIFTY’s top-loser after announcing results yesterday.

HDFC Bank (-1.8%), Kotak Bank (-1.5%) and IndusInd Bank (-1.5%) were among the top-losers on NIFTY 50. Foreign investors reduced their stake in IndusInd Bank by 3.8% in the last quarter.

Polycab(+8.2%) gave a fresh breakout and closed at all-time highs.

Tata Stocks remained buzzing in the day led by Tata Steel (+6.4%) in NIFTY 50. Trent (+3.2%), Tata Elxsi (+4.7%), Tata Power (+3.1%), Tata Chem (+2.1%) and TCS (+0.98%) were among some that closed with good gains.

Sugar stocks showed bullishness again led by Balrampur Chini (+4.9%), Shree Renuka (+3.1%), Triveni (+3.8%) and Dalmia Sugar (+3.3%).

Markets Ahead

Markets Ahead

The weekly expiry turned out to be very anti-climatic. It had all the ingredients ready for a very exciting day, but NIFTY closed the day exactly where it opened.

Infosys and TCS results failed to create a big impact and Wipro did not have enough weightage on NIFTY to move it down. So for now, the market is at an uncertain level just under 2% from its all-time high.

Bank Nifty has more breathing space with a more than 8% gap from its all-time high. However, the index has made a red candle in the daily charts for the first time since 29th December. It looks like time for a breather in the market.

But interestingly, I also think that the weekly expiry decided many of the moves today. In the month of December, Fridays and Mondays were the days which showed interesting movements. So I will be looking for the movements tomorrow to see if NIFTY takes support at 18,200 and continues to move up.

Do you think this bullishness will continue in the market? Can NIFTY break 18,500 and move up to all-time highs?

See you on The Stock Market Show at 7 PM!