Today’s Market Summarised

Who can save Nifty now? Just the day after Republic Day celebrations, India’s financial markets have taken a huge dip and fallen below multiple supports.

After opening with a gap-down at 14,201, the first candle in Nifty beautifully took resistance at yesterday’s low. It continued this fall across the whole day, making lower highs and lower lows. Nifty even fell below 14,000 level without much effort. The index closed the day at 13,967, down 271 points or 1.91%.

Bank Nifty was also bearish, but fell much much more. After opening flat near yesterday’s close, it tried to go up and touched a high of 31,280. From there, it was honestly surprising to see how easy the index fell more than 1100 points from the day high to the day low. Bank Nifty closed the day at 30,284, down 913 points or 2.93%.

All indices except NIFTY FMCG closed in the red today. Last day it was Pharma who was in the green, and today even it has closed more than 2% down. IT managed to close nearly only 0.6% down.

Asian markets traded mixed, but generally are looking very flat. European markets are all in the red at the time of our market close.

News Picks

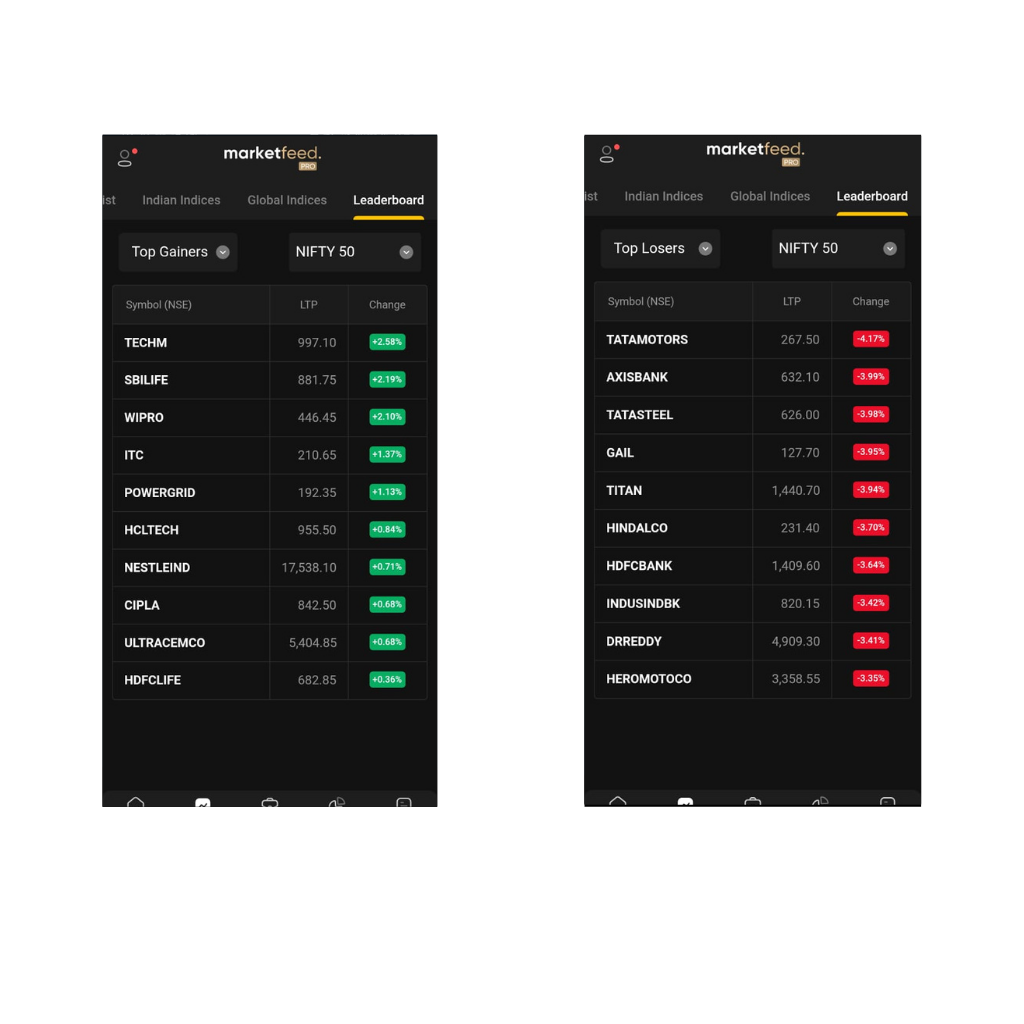

IT companies who fell during the last Nifty fall managed to stay in the green today. While heavyweights TCS and Infosys fell(along with Naukri who is seeing a LARGE correction), TechM and Wipro managed to close more than 2% up.

Insurance companies’ share went up with SBI Life up 2.19% and HDFC Life marginally up in a bearish market.

ITC being ITC went against the market and closed more than 1.35% up in the day. FMCG stocks including beverages companies UBL(up 4.22%) and McDowell-N(up 1.55%) went up in the day while Jubilant Foodworks fell 3%.

Shares of Marico who were trading in the green all day till 2 pm fell SHARPLY ahead of the results announcement and gained back almost all losses just as fast. You have to open the charts to believe the volatility. The company announced a 13% year-on-year rise in profits to Rs 312 crores.

Shares of Hindustan Unilever fell till noon before slowly closing back in green. After market hours, the company announced that net profit is up 18.9% YoY to Rs 1921 crores, for Q3.

Last weeks outperformers, including Tata Motors and Hero Moto Corp featured in the top-losers section in Nifty 50 today.

Shares of Nifty heavyweight Reliance, fell more than 2.37% today. The stock pulled the Nifty 50 index down 39 points. Global ratings agency Macquarie had announced 12-month target price of Rs 1,350 per share for the stock, which saw a lot of fear being spread in the market.

Shares of HDFC Bank fell more than 3.64% as sell-off in financial stocks got even stronger than last many days. The stocks together pulled Nifty 50 down 53 points while pulling Bank Nifty down 310 points.

HDFC also fell 3.31%. That means Reliance, HDFC and HDFC Bank alone pulled Nifty down by 130+ points in today’s 270 point fall.

Markets Ahead

Over the last 4 days, Nifty has fallen more than 750 points while Bank Nifty has fallen more than 2500 points.

Smallcap stocks performed better today in the entire market space. The index ended up by 0.1% midcap index fell 1.6%.

What is a bit interesting to me is the thought of if markets are just in a “correction” phase or a falling phase. With over 10 stocks from the Nifty 50 closing in the green, there is clearly some buying interest left in the market. But in the cases of all previous sharp corrections, very few stocks would have closed in the green. Global markets are falling too, with Europe also in red. Maybe this is the actual fall everyone has been waiting for?

Meanwhile, India’s capital city is also under a lot of international investor’s eyes as clashes between protesting farmers and Police erupted. Keep a watch of this situation along with the Central Govt’s official stand on the issue, and maybe even for the Prime Minister’s announcement.

The US Federal Reserve meeting is expected to not have a very positive outlook on the economy. Along with this, our budget announcement is awaited by Monday. Markets will remain cautious and may trade sideways with a bearish view as profits/losses are booked.

Hope you will all tune in to The Stock Market Show tonight. Keep watching this space for more.