What Happened Yesterday?

NIFTY started yesterday at 22,337 with a gap-up and fell. After taking support at 22,200, the index moved back up. A breakout was seen above the day-high after 3 PM, and NIFTY ended the day at 22,336, up by 189 points or 0.86%.

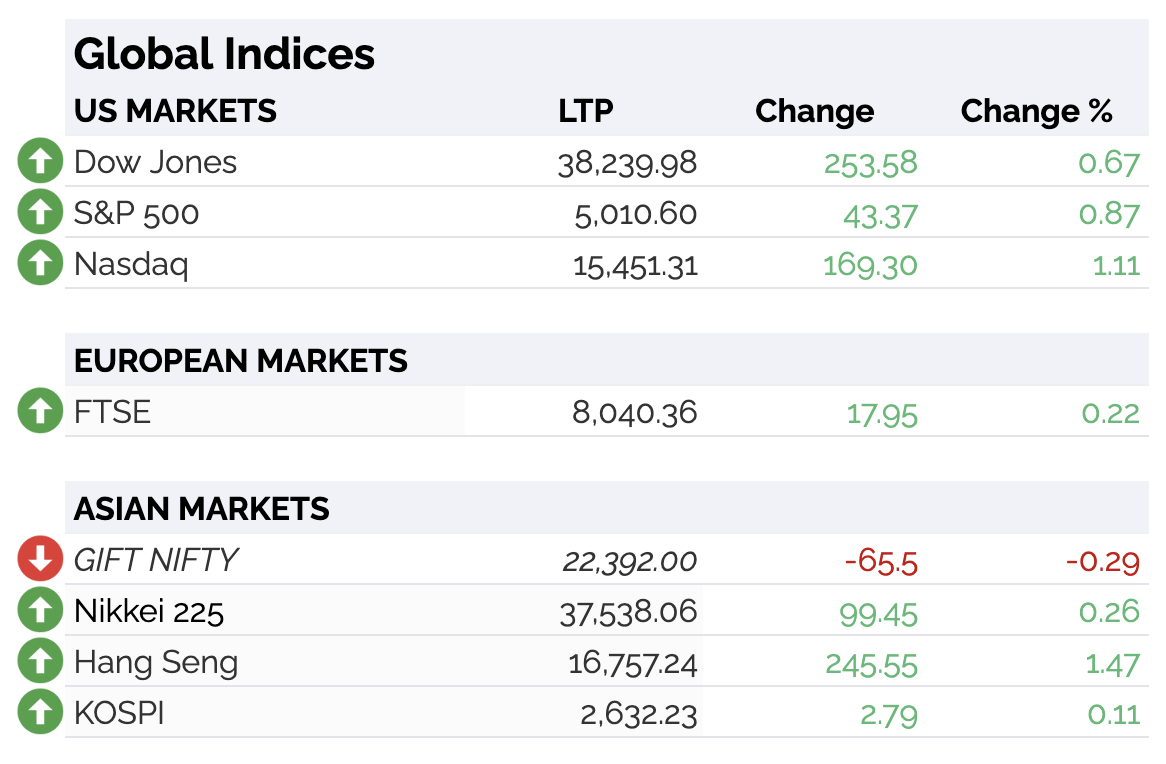

U.S. markets closed in the green. The European markets also closed in strong green.

What to Expect Today?

What to Expect Today?

Asian markets are trading in the green.

The U.S. Futures is trading in green.

GIFT NIFTY is trading flat at 22,392.

All the factors combined indicate a flat opening in the market.

NIFTY has supports at 22,280, 22,200 and 22,000. We can expect resistances at 22,440, 22,510 and 22,600.

BANKNIFTY has supports at 47,800, 47,600 and 47,420. We can expect resistances at 48,080, 48,160 and 48,300.

FINNIFTY has supports at 21,270, 21,200 and 21,080. We can expect resistances at 21,380, 21,470 and 21,560.

NIFTY has a high call OI resistance at 22,600 and 22,500. There is a high put OI support at 22,300. PCR is at 1.06.

BANKNIFTY has a high call OI resistance at 48,000. There is a high put OI support at 47,500. PCR is at 1.01.

FINNIFTY has a high call OI resistance at 21,500. There is a high put OI support at 21,300. PCR is at 1.11.

On Friday, Foreign Institutional Investors net–sold shares worth Rs 2,915 crores. Domestic Institutional Investors net–bought shares worth Rs 3,542 crores.

INDIA VIX fell to 12.70.

The market is stabilising after last week’s fall due to the Israel war and Mauritius Tax treaty news.

Ahead of the elections, we currently have the results season. Today our markets will react to the Reliance results.

There is still a high call OI interest at 48,000 in BANKNIFTY. This is despite yesterday’s 350-point rally in the index. This level in the morning will be important.

So the market moving up yesterday was mostly due to international market recovery. Now that GIFT NIFTY is indicating a flat opening, we will get to know the true direction of the market.

Exit poll data is being collected around the country. As more and more states go into voting, the market has a high chance of being volatile.

I think we are yet to see volatility from HDFC Bank. Watch out for that 1558 level breaking eventually.

For the FINNIFTY expiry, be careful of the last 30 minutes too. When market players are getting too aggressive, it would not be a bad idea for you to prioritise safety.

We will be continuing our NIFTY trades and BANKNIFTY trades today. You can check out our trades on the marketfeed app or our website!

All the best for the day!