Today’s Market Summarised

Nifty was very volatile today, ahead of tomorrow’s weekly expiry. The main event that sent markets flying in both sides was the official announcement of the approval of Pfizer vaccine. Nifty opened the day with a small gap and made a large red candle. This was quickly made up but Nifty took resistance near the very strong 13,124-13,130 zone. When the vaccine approval in UK was announced, Nifty corrected to make lows near 13,000. This big fall was overcompensated soon, with NIFTY touching the resistance zone once again. The index closed the day at 13,113.75, up just 4.70, or 0.04%.

Bank Nifty opened the day at 29,883 and made the day’s high then and there. The index of banks fell consistently from there. When Nifty moved down, Bank Nifty created long red candles. The index took support near 29,150 and tried to move back up. Although the move was not as strong as Nifty’s, Bank Nifty closed the day at 29,463.15, down 354.70 points or 1.19%.

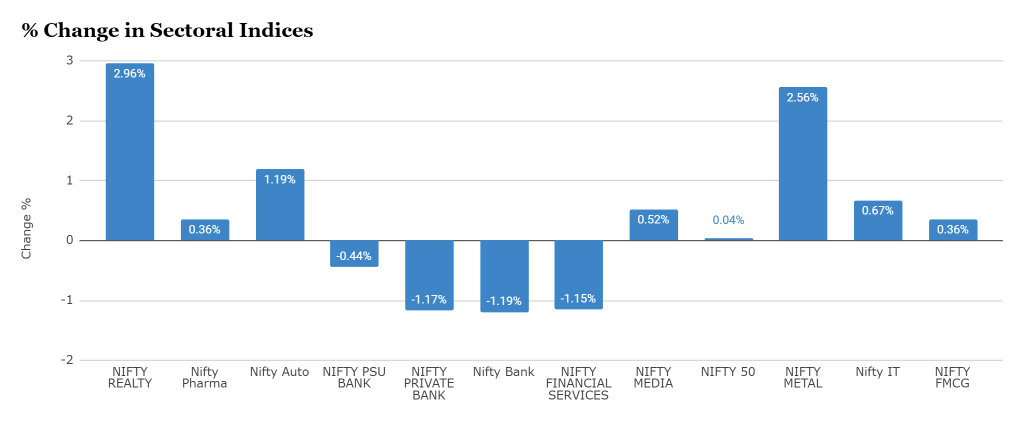

Realty stocks and metal stocks performed the most today. Banks and financials closed the day as net losers.

Major Asian closed mixed today. All European markets are trading flat today.

News Picks

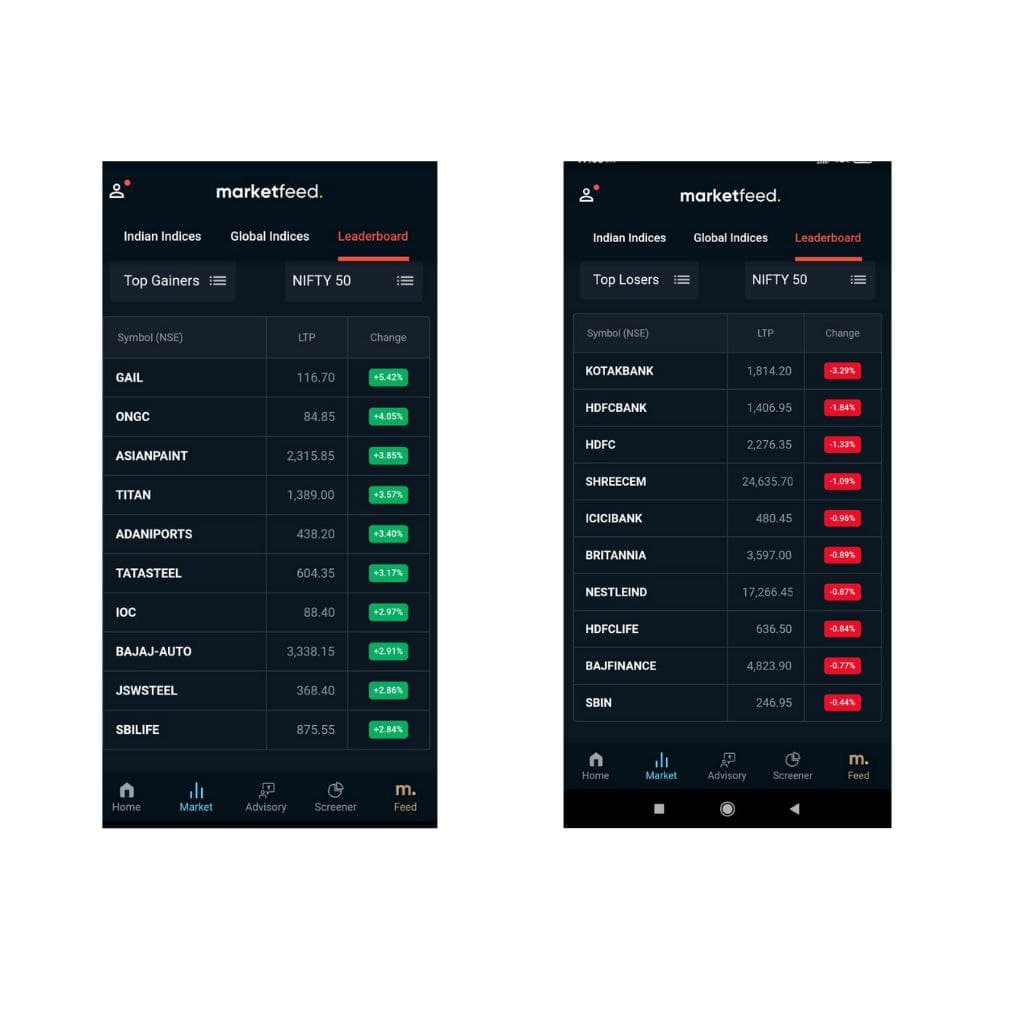

ONGC and GAIL went up to continue their rally. They were the top gainers in Nifty today. Natural gas companies are going to enjoy better prices from last week’s key decisions regarding the industry.

Financials came under selling pressure as NIFTY fell sharply in the afternoon. They were slow to recover. The fall was led by today’s top losers Kotak Bank, HDFC, HDFC Bank and ICICI Bank among others.

Phoenix Mills and Singapore’s sovereign wealth fund GIC are setting up retail-led real estate platform, as reported yesterday. This news sent the company’s stock flying with prices up more than 11%. This boosted the confidence of realty sector and helped it become the best performing sector from today.

Burger King IPO was fully subscribed on its first day. You can read all about the company here, before deciding to invest.

Adani Ports share prices hits 52-week high after cargo volume rises 10% YoY. The stock has been a swing pick of our from over 3 weeks ago.

Markets Ahead

It was announced that the Pfizer vaccine has been approved for use in the United Kingdom. It would be available for widespread use starting as early as next week. However, the vaccine would not be usable in India, as it needs -70 degrees while transporting. In my humble opinion, the Foreign Institutional Investors(FIIs) pumping in money would pull out to invest in European countries as their economies are now likely to get back stronger than ours. Thus, a correction in Nifty can be expected, especially since the Pfizer vaccine is not usable in our country.

You can look for buying opportunities in the IT sector, along with going short on gold if you are a commodity trader. Petroleum prices are also likely to go up, as global consumption will increase post-covid. Can take a look at the FII/DII data to have a clearer picture of what could happen in the market tomorrow.

Hope you will all tune in to The Stock Market Show tonight. Keep watching this space for more.