Today’s Market Summarised

A ray of hope in the form of a small pullback in the market. All major sectoral index opened with gap-ups on the day after yesterday’s sharp falls.

Nifty opened the day with a 180-point gap up at 14,507. In the first hour, it struggled to stay above 14,500 and 14,400 ranges acted as good support. With power from Tata Group companies, the entire market fired up. It even touched yesterday’s high and then slowed down. Nifty closed the day at 14,507, up 182 points or 1.27%. It was exactly the same as today’s open level.

Bank Nifty had a very calm day in the market. After moving in a range of 1,300 points yesterday, Bank Nifty moved just over 400 points in the day. After opening with a gap-up at 33,610, the index moved sideways and managed to stay above 33,100 the whole day. Bank Nifty closed the day at 33,318, up 311 points or 0.94%.

All sectoral indices closed in the green today. Nifty Metal, which was flat in yesterday’s fall, went up 3.68% in the day. Nifty FMCG, Nifty Realty, Fin Nifty and Nifty Auto closed more than 1% up in the day.

All major Asian and European markets have closed in the green today.

News Picks

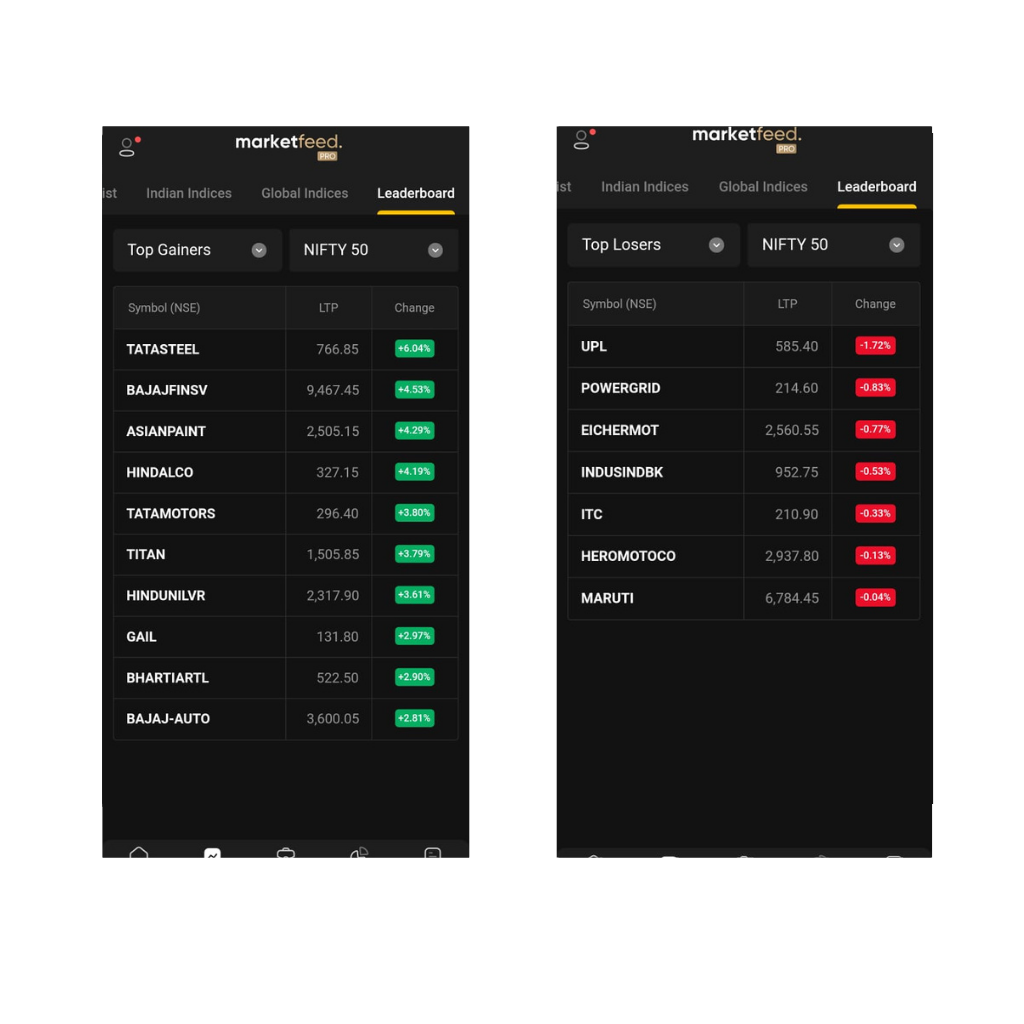

Unlike previous days, only 7 stocks from Nifty 50 closed in the red.

All Tata Group stocks shot up in the day after the Supreme Court backed the removal of Cyrus Mistry. Ruled in favour of Tata Sons, sets aside NCLAT order. Was interesting to see how this move lifted up the entire market at that time, even though later stabilised. Can check how every Tata stock gained more than 1-2% at 11:20 am.

Shares of Godrej Properties closed up 2% in the day. The builder sold more than 275 residences worth Rs 475 crore just today at the launch of Godrej Woods in Noida.

Even when global prices of base metals remained weak, all Metal stocks rallied and closed green in the day. Monthly production data for March will be out by the first week of April, and the index saw heavy buying in hopes that it will be good. Tata Steel was up 6%, SAIL by 6.23%, Hindalco up 4% and Jindal Steel by 4.8%.

With Bajaj Auto is set to launch the Pulsar 250 soon, share prices closed 2.8% up. It is also planning to launch an electric bike/scooter by 2022 in collaboration with Pierer Mobility(parent of KTM, Husqvarna).

Kalyan Jewellers and Suryoday SFB listed at a discount from IPO price in the market. Barbeque Nations IPO closes today but has seen very low participation being subscribed only 4.2 times.

With rumours that malls will soon increase back rents, Inox and PVR shares fell more than 1% each.

With fears that the second wave of Covid-19 will hit air travel, Indigo shares fell more than 3% in the day. SpiceJet opened with a gap-up and fell to close 0.8% up. Also, SpiceJet’s Ajay Singh along with Ankur Bhatia have bid for 100% stake in Air India.

Container Corporation of India gained 7% to resume rally to all-time highs. The stock is currently set for privatisation and has drawn interest from DP World, Adani and Vedanta.

Finance stocks performed well in the day lead by Bajaj Finserv and HDFC. Muthoot Finance, Manappuram Finance, Chola Finance and Mahindra Finance gained 3-5.5% in the day.

Service industry stocks generally performed well in the day. EaseMyTrip closed at its 20% upper circuit after seeing heavy buying. Deltacorp was up more than 8% followed by Indian Hotels at 5.34%.

Markets Ahead

The Supreme Court judgement siding with Tata Sons was the event of the day. Otherwise, Nifty has consolidated in the day if you don’t consider the gap-up. Bank Nifty also saw heavy consolidation in the day.

14,500 has been respected today and I am happy that Nifty closed above this level.

The markets have closed on a positive note, but nearly 1.5% down for the week. Maharashtra Govt is set to take a decision after April 2 on whether to impose a complete lockdown in the state once again. Do remember that Mumbai was one of the worst affected cities in the first wave of Covid.

The April series has opened with some positivity and let us hope that 14,750 is taken out soon to confirm Nifty’s short term bullishness. 15,100 would be the next, followed by the all-time high. Looking down, 14,500, 14,200 and 14,000 are good supports for the index.

Do remember that is Monday will be a holiday in the market and you are in for a long weekend. Happy Holi to everyone in advance. Celebrate responsibly while still enjoying the weekend.

Catch you all on The Stock Market Show tonight!