Today’s Market Summarised

Nifty had a gap-up opening strongly above the 11,600 mark at 11,609. After making a day-high of 11,617, the index consolidated between 11,585 and 11,610 (check charts). Upon opening of European markets in red, Nifty started falling. The index closed the day at 11,559.25, up +9.65 points or 0.084%.

Similarly, Bank Nifty opened at 23,516 with a gap-up. The index continued to move up and consolidated between 23,550 and 23,700. Bank Nifty closed at 23,600.35 points, up 186 points or 0.86%. With this, the index has risen 1,500 points in the last 5 trading sessions.

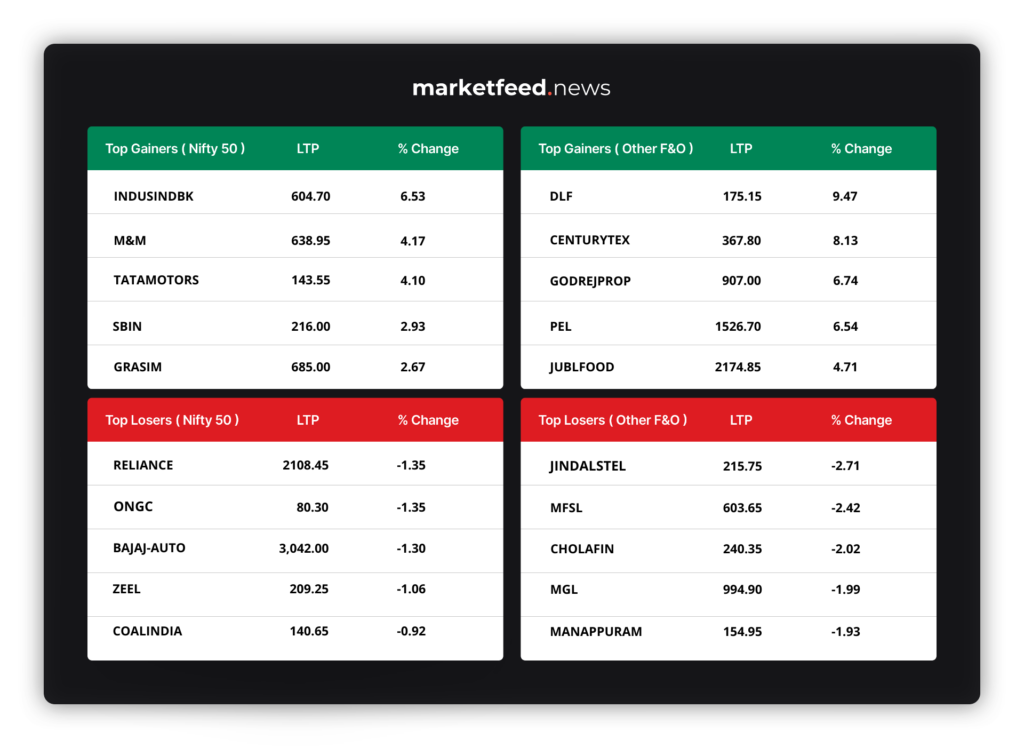

Nifty Realty moved the most, closing up 6.4%. Shares of DLF (up 9.47%), Prestige (up 8.19%), Oberoi Realty (up 7.06%) and other companies involved in the business of building homes were among the top gaining stocks of the day. This was on the back of Maharashtra state slashing taxes on home purchases. Our views were shared on Telegram, as well as in the morning article. Hope you caught the rally!

Asian markets are mixed. European markets are trading in red, and it affected Nifty as well in the afternoon session.

News Picks

Mahindra & Mahindra closed the day at ₹639/share, up 4.18% to get on the Top Gainers list today. The company had signed a pact with Israel based ‘REE’ to develop electric vehicles in India.

Shares of IndusInd Bank and State Bank of India rallied after financial services company UBS upgraded their rating from sell to buy. “We think the sector’s downside risks are limited and upgrade IndusInd Bank and SBI from sell to buy,” UBS said in a statement. SBIN gained 2.93% to close at ₹216/share. IndusInd closed up 6.53% at ₹604.70/share.

Shares of ICICI Bank rallied almost 2% intraday, with easy entry and exit opportunities for traders. Trading closed at ₹392.90, up 0.91%. ₹400 is a big psychological resistance for the stock, so do watch out for that level. This jump has been attributed to the bank offloading 2% stake in ICICI Securities for a net amount of ₹326 crores. Did you catch this in the morning marketfeed article?

Shares of Gillette India closed at ₹5,650, up 2.27%. The company had reported a 1.85% fall in net profit to Rs 44.97 crore for the quarter ended June, but beat street estimates. There were opportunities for trading in both sides of the table as the stock was volatile. Repeating again, all news creates volatility. News need not determine the immediate direction of the movement of a stock.

Shares of Equitas Holdings closed at ₹56.20, up 1.90% after creating a day-high of 57.15. Last day, Societe Generale had sold 22,19,200 shares of Equitas Holdings at Rs 55.36/share. Once again, news creates volatility for scalpers.

Shares of Hindustan Aeronautics Ltd fell to ₹1,010.00, down 14.23%. Trading opened at ₹1,041.10/share and was guaranteed to fall further as the government had decided to sell 15% stake at a 10% discounted floor price of Rs 1,001. Bids opened today for Non Retail Investors and will be available tomorrow for Retail Investors with 5% discount.

Shares of Blue Star closed at ₹677.50, up 8.98% after making a day-high of ₹723.7. The stock gained momentum after breaking its 200-day moving average. Shares of companies in the air-conditioning and ventilation segment have been in the rise lately.

Shares of Voltas closed at ₹665.00, up 2.50% after making a day high of ₹668.5. Did you catch the movement? Follow @fundfolio on Telegram for more picks like these.

Shares of Bharat Forge closed at ₹512.55, up 2.68% after making a day-high of ₹519.25.

Minutes of the GST Council meeting will be updated in tonight’s Top 10 News article as it’s still currently underway.

Markets Ahead

India’s largest listed brokerage, ICICI Securities, has predicted that the Nifty 50 Index is expected to reach its all-time high near 12,400 by March 2021. The firm, led by some of the country’s best analysts, expects the rally in stocks to continue.While this can not be taken as a blind-advice, the confidence of the brokerage will surely lift the market’s mood. Easy opportunities like today’s rally of Realty stocks are being presented at least once a week by the market. If you are able to catch these one-off opportunities, then at the very least you can get 1-2% returns per week. These safe bets are available in the market for those who wait patiently, and for those who read Marketfeed daily.