Today’s Market Summarised

NIFTY sees profit booking after scaling new all-time highs.

Nifty opened the day flat at 17,165 with a small gap-up and shot up to new all-time highs. The index touched a fresh all-time high of 17,225 by 10 AM then came under profit booking. Nifty broke trendlines and moved down, closing at 17,076, down 56 points or 0.33% for the day.

Bank Nifty opened the day at 36,618 and was looking super bullish. 36,800 was broken with ease and even the 37k mark, its highest since February. Profit booking pulled down the index just below the 36,500 mark near 3:30 PM, below the rectangle we drew in yesterday’s chart.

Bank Nifty closed the day at 36,574, up 150 points or 0.41% for the day.

Nifty Realty(+5.5%) saw high bullishness and closed as the top-gainer. Nifty Metal(-1.7%) saw profit booking along with the Nifty IT index(-1.3%), while others consolidated.

Asian markets closed mixed in the day. European markets are also all trading in the green currently.

News Picks

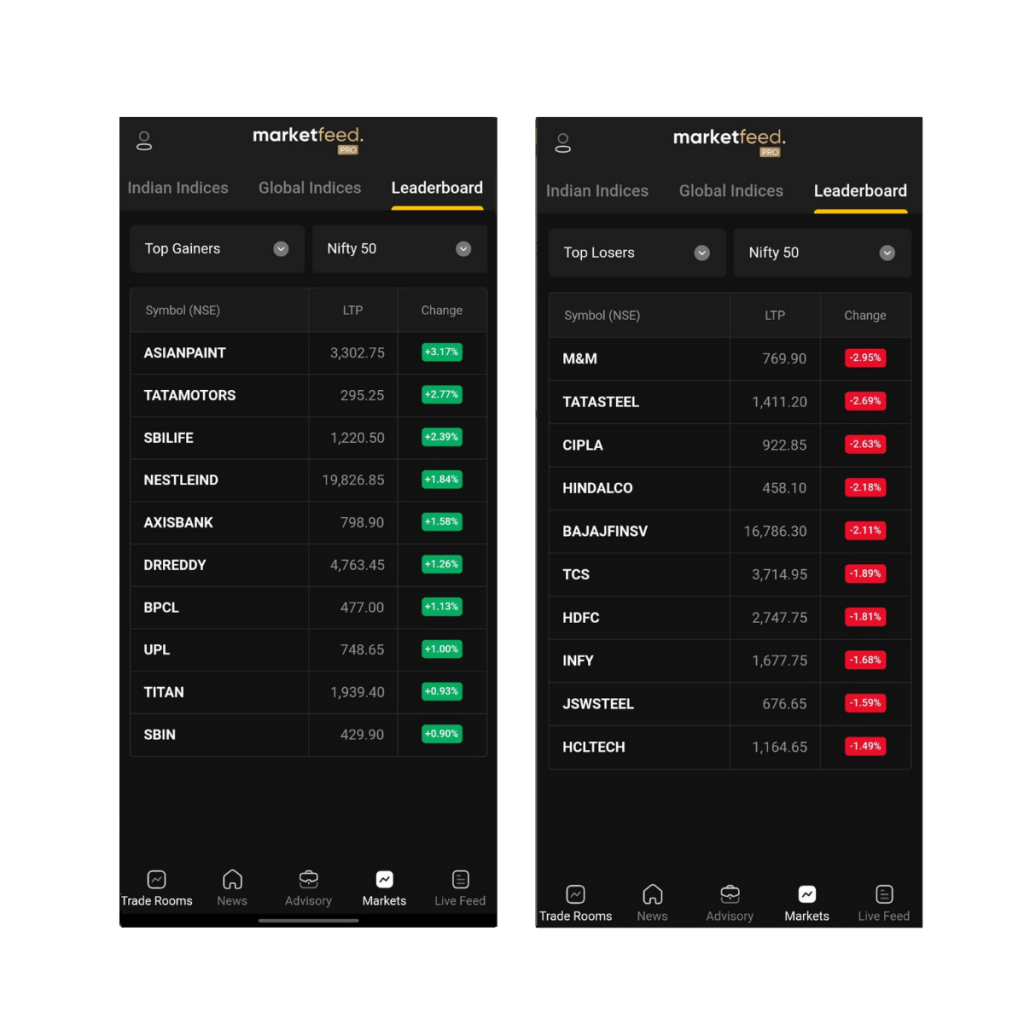

Asian Paints(+3.1%) gave a breakout and closed as Nifty’s top-gainer.

Auto sales data have started getting published. Tata Motors(+2.7%) moved with August Total Sales reported at 54,190 units, up 52% from last year and 4% from last month. The estimate was at 51,100 Units. Tata Motors EV sales crossed 1,000 units this month.

However, Maruti(-0.9%) fell after the sales for August came in at 1.30 lakh units, down 20% month-on-month. The estimate was at 1,34,000 units.

Bajaj Auto(+0.8%) moved up slightly after announcing August total sales at 3.73 lakh units against an estimate of 3.60 lakh units.

India’s August Power Generation is up 16.1% against last year and up 2.9% vs July. The power market also reported all-time high monthly volume of 9538 MU on August 21, a 74% growth compared to last year. IEX closed 11% up. Are you invested in the company?

Adani Power(+5%-UC) and Adani(+5%-UC) Transmission also moved in the day.

M&M(-2.9%) fell after August sales came at 30,558 units vs 42,983 last month. The estimate was at 40,700 units.

Metal stocks saw corrections with Tata Steel(-2.6%), Hindalco(-2.1%) and JSW Steel(-1.5%) featuring in the top-losers section.

Similarly, IT stocks saw correction with TCS(-1.9%), Infosys(-1.6%) and HCL Tech(-1.5%) closing in the red.

GMR Infra(+4.3%) Group to invest Rs 500 crores in metro rail link project to Hyderabad airport.

EPL(+3.7%) has partnered with Colgate(+0.47%) for the creation of the first and ever recyclable toothpaste.

EQUITAS SFB(+5.2%) launched digital fixed deposits on Google Pay. Equitas Holdings(+6%) also moved up.

Consumer electronics stocks including Havells(+6%), Crompton(+3%), Voltas(+5%) gained in the day.

BHEL(+4.5%) moved up after bagging an order worth Rs 10,800 crore from the Nuclear Power Corporation of India for machinery.

Exide Industries(+5.5%) moved up after it said they are looking at manufacturing lithium-ion batteries, currently used in electric vehicles. The company is waiting for details of the Production-Linked Incentive scheme.

Most stocks from Abbott India(+3.9%), Crompton Greaves(+3%), Dalmia Bharat(-2.6%), Delta Corp(+4.2%), The India Cements(+7.5%), JK Cement(+3.7%), Oberoi Realty(+10.6%), and Persistent Systems(+0.3%) moved sharply with news of inclusion in F&O list.

Realty stocks were highly bullish in the day. DLF(+3.8%), Godrej Prop(+4.8%), Oberoi Realty(+10.6%), Phoenix Mills(+4.4%), Prestige Estates(+5.5%), IBREALEST(+5.7%), Brigade(+7.5%) and Sobha(+10%) closed in the green.

Markets Ahead

Nifty saw profit-booking in the day, breaking a trendline it started last day. Looks like it is time for the index to take some rest before moving more.

Bank Nifty still has strength and has closed around the 36,500 mark. The bullishness was seen in the morning, and this level was mostly taken as support through the day, but broke near the ending. A gap-down will make the level once more into a tough resistance.

The most interesting part of today was how Bank Nifty effortlessly rallied till the 37,000 mark. AU Bank gave a rebound in the morning but fell later, after clarifying the events which led to yesterday’s 12% fall in the stock.

In general news, IMD(India Meteorological Department) expects above-normal monsoon rainfall in September. You can check out how monsoon affects the Indian stock market, here.

Bank Nifty fell back into the 3-month channel after the first-hour jump. Will be interesting to see if the index will take support at 36,500 and bounce up.

How did today go for you? Did you observe the No Trading Day today? Let us know about it in the comments section of the marketfeed app!