Today’s Market Summarised

With rising Indo-China tensions and upcoming GDP results, Nifty bled heavily after its green opening. Nifty 50 opened at 11,777 today with a gap-up that astonished every participant. Retracements were expected and the market started falling to cover the gap-up. Nifty broke all supports formed over August to close at 11,387.50, down 260.10 points or 2.23%.

Nifty Bank lost most of its Friday gains to close the day at 23,666.60 down 769.14 points or -3.50%. The index was among the top losers of the day. Every sectoral index closed in red for the day.

European markets and Asian markets are mixed.

News Picks

Traders would surely have enjoyed the markets today. It was clearly one-sided and set to fall. But even an experienced trader would not have guessed the market would fall above 2% in a single day today. With tensions in Ladakh rising over escalation by China, the markets seem to have gotten the wake-up call they needed. Surely, the announcement of GDP data later in the day would not have given any confidence to the index either.

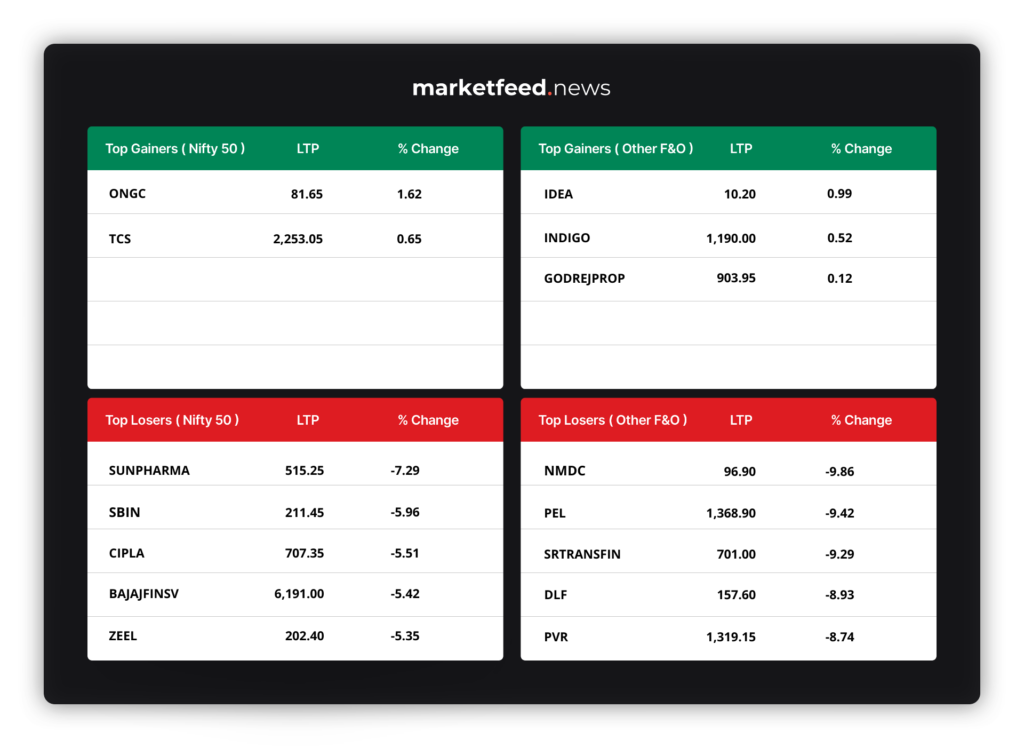

Sunpharma was the top loser in the Nifty 50 index today. Shares of the company closed at ₹514.5, down 7.42%. Pharma stocks were clearly weak from the start today. Anyone who opened the chart could have made a profit from this trade. Hope you caught this fall!

State owned NMDC fell -9.81% to close at ₹96.95 to become the top losing F&O activated stock today.

Broader markets had it worse due in the selling pressure. Both the midcap and smallcap index fell over 4% in today’s session. Thus the 10-day winning run of the midcap index came to an end today. Possibly the worst part of trading in midcaps without stop losses would have been made clear today. When the general market falls, small-caps and mid-caps always fall harder.

Only 2 stocks out of 50 from Nifty closed in green today. Only 3 out of 146 F&O listed stocks closed in green today.

Markets Ahead

August 31st concluded to be a very interesting day. Starting tomorrow,the moratorium imposed on loans will be lifted. This will reveal a lot of bad loans yet to hit the banks.New SEBI regulations on equity market trades are set to be imposed from tomorrow, and are said to setback the industry by decades. Indo-China escalations spooked the market, with war tensions resurfacing. Gross Domestic Product (GDP) data is said to come out today, with economists expecting a 15-25% shrinkage in numbers. Auto sales and cement sales data for the past month is also set to come out soon.

If you believe that the Indian economy will sustain in the long-run then consider this dip as a strong buying opportunity. Do watch out Top 10 News by Marketfeed which will cover all the GDP and sales data, as and when they come out. Gold prices have started rising back, as a result of investors using the shiny metal as a safe-haven asset. If you were a trader, there were clear opportunities on the shorting side today. Hope you caught a few points in your trade today. Investors can look to accumulate in the dip created, but do watch out for Nifty’s current support of 11,430!