Today’s Market Summarised

Nifty consolidated heavily today. But this did not stop good stocks from giving good movement throughout the day. After opening with a gap-up at 13,992, Nifty immediately crossed the 14,000-mark and there was no looking back. The index made a day-high just near 14,050 and took 14,000 as a support. Nifty closed the day at 14,018, up just 36 points, or 0.26%.

Bank Nifty was consolidating with a slightly bearish bias over the entire day. After opening with a slight gap-up near 31,280, Bank Nifty quickly went up to made the day high just below 31,400. From there the index fell slowly but surely throughout the day, to end near the day low. Bank Nifty closed the day at 31,225, down 38 points or 0.12%. Even though PSU Banks outperformed, it had no impact on Bank Nifty.

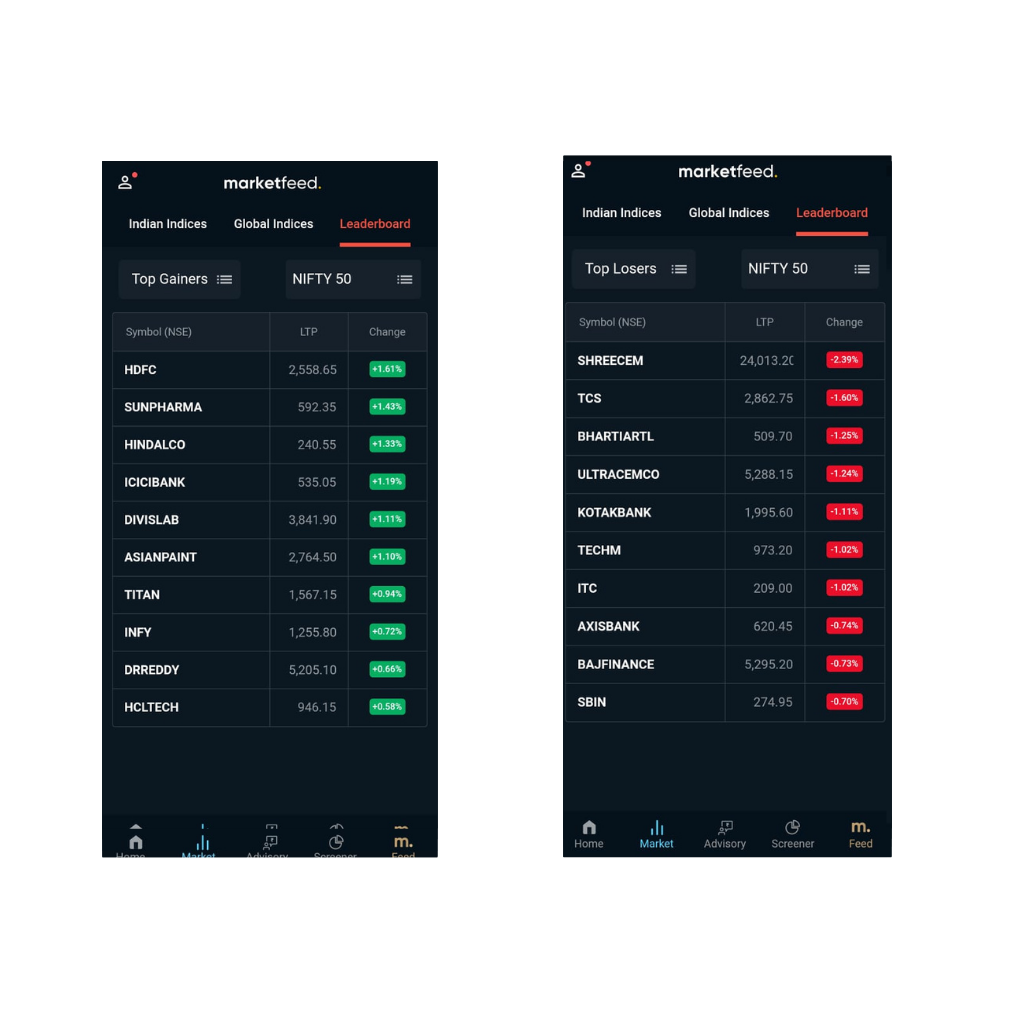

PSU Bank index moved the most today, along with Autos and IT. Bank Nifty and Private Banks closed barely in red for the day.

Asian markets closed mixed for the day. European markets are closed for the day.

News Picks

Shares of Adani Ports went up by more than 4% to close above Rs 500-mark for the first time. Earlier this week, Adani Ports had received a green nod for Rs 12,256 crore, Phase 3 expansion of Krishnapatnam Port.

TCS shares jumped after the company completed acquisition of Postbank Systems from Deutsche Bank AG.

Shares of Antony Waste Handling Works listed on the exchanges with a more than 30% listing gain. Listing price was around Rs 430 compared to the IPO issue price of Rs 315. Prices settled to close just above Rs 400 for the day. Did you get an allotment in this IPO?

Auto stocks featured in the top gainers list after December auto sales data from manufacturers came out during the day. India’s largest 4-wheeler manufacturer Maruti Suzuki reported a 20% year-on-year rise in sales at 1.60 lakh units.

After shares of Sobha performed yesterday, today was the day for DLF, who went up more than 1.6% today. The stock is near a key resistance of 240, and the 1-day chart can be watched.

After receiving a Rs 3,200 crore order from Nuclear Power Corportation and multiple hydro project orders last day, BHEL continued its rally and went up 7.80% today.

Shares of auto and realty finance companies, including LIC Housing Finance, Chola Finance and Shriram Transport Finance went up today. The auto sector is seeing improved sales in the December monthly data, and realty sector is also performing well. HDFC shares remained flat, with the stock already at its all-time high.

Markets Ahead

The vaccine news is still not out yet. But still, there are reports flying around about that the Oxford-AstraZenaca vaccine will be the the first to be approved. Nifty consolidating heavily could have been a sign of big players waiting for a solid news from this space.

Even with the rupee getting stronger, IT companies rallied today. The Q3 earnings are set to be out soon, and this might be the reason why. We had written an in-depth article about top IT companies and there expected performances in Q3, here.

If you look closely, you would have clearly seen the lower volume in Nifty 50 stocks today. ‘Smart money’, or the money flowing in from institutional investors move to midcaps when there is uncertainty or consolidation in the general market. Midcaps can be looked into more in the coming days.

Hope you will all tune in to The Stock Market Show tonight. Keep watching this space for more.