Federal Bank declared its financial results for the July-September quarter (Q2 FY22) on October 22. There was high demand for the stock in Dalal Street on the same day and surged ~8%. During the same period, ace investor Rakesh Jhunjhunwala added 2 crore shares of Federal Bank (~1% of the total equity share capital) to his portfolio. Currently, his holding value in the bank is ~Rs 750 crore.

In this article, let us analyse the recent financial performance of the bank and compare it with that of its peers.

Federal Bank’s Q2 Results

The bank’s Net Interest Income (NII) increased 7% year-on-year (YoY) and 4% quarter-on-quarter (QoQ) to Rs 1,479 crore in Q2. NII is the difference between the interest income received on loans and the interest paid to depositors. Meanwhile, Net Interest Margin (NIM) improved to 3.2%. For every Rs 100 issued as a loan, the lender can generate Rs 3.2 as an income after paying interest on deposits.

The net profit of the bank increased 49% YoY and 25% QoQ to Rs 460 crore. The increase in profits can be attributed to increasing NII and a decrease in the provisions made for bad loans.

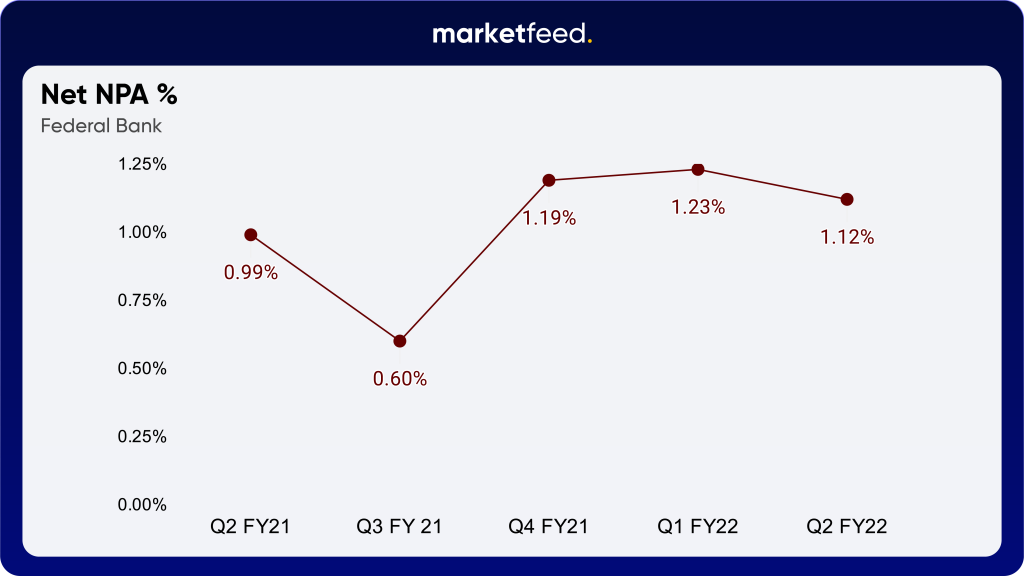

Net Non-Performing Assets (NNPAs) are the loans given out by the lender that fails to generate interest. Thus, if the bank does not manage the NPA wisely, it can eat up the profits of the bank.

Here, we can see the trend of Net NPA. Even though the current position is greater than that of the previous year, its decline across the previous quarters is a good sign. Federal Bank has an NNPA of 1.12%, meaning that for every Rs 100 given out as a loan, Rs 1.12 turns as NPA.

Comparison with Peers

For any sector, analysing a company along with its peers gives us a clear picture. Let us compare and analyse Federal Bank with the top-performing banks in India.

Net Interest Margin

Net Interest Margin (NIM) is a measure of a bank’s net interest income (NII) to its assets. A higher NIM is always appreciable.

Although Federal Bank has a lower NIM, the metric increasing over the quarters is a good sign.

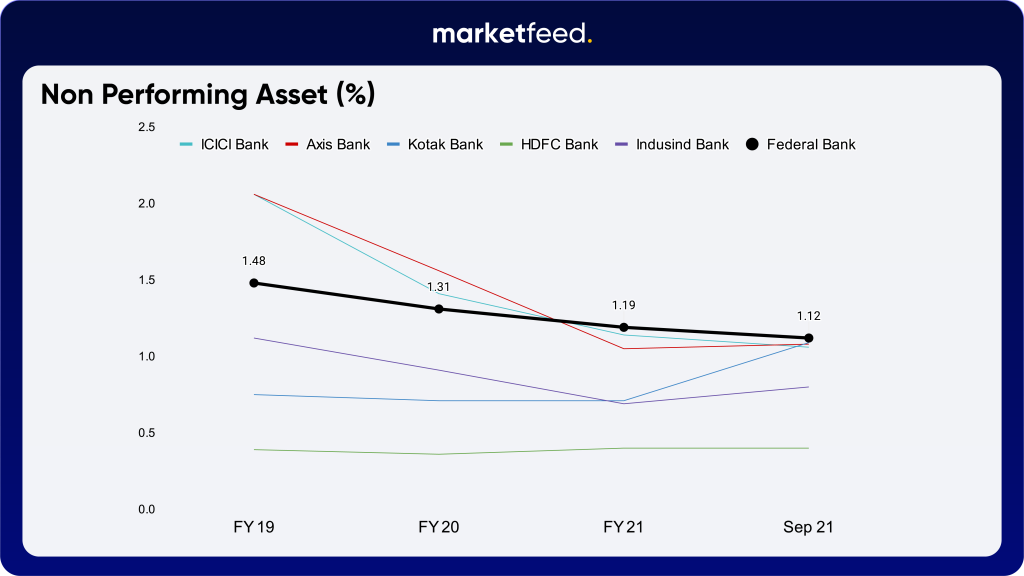

Non Performing Assets

A loan becomes a Non-Performing Asset (NPA) when it fails to generate income for the bank. Net NPA shows the percentage of money given out as a loan that cannot be retrieved by a bank. Thus, a very low NPA is preferable for a bank.

Federal Bank has higher NPAs than its peers. Fortunately, the decline of bad loans across the years is a good sign. Even though the other banks have reported higher NPAs over the previous quarters, Federal Bank was able to reduce the same.

CASA Ratio

Current Account – Saving Account (CASA) are deposits that provide relatively low interest. If a bank has a high CASA Ratio, it means that the bank’s expenses are low. If a bank has a lower CASA ratio, expenses will be high and it will affect Net Interest Margin (NIM).

Federal Bank has a CASA Ratio of 36%. It means that for every Rs 100 deposited in an account, only Rs 36 belongs to CASA. Here, the CASA of Federal Bank is relatively lower compared to other banks. Therefore, picking up CASA is essential for the lender to gain a better income.

Valuation

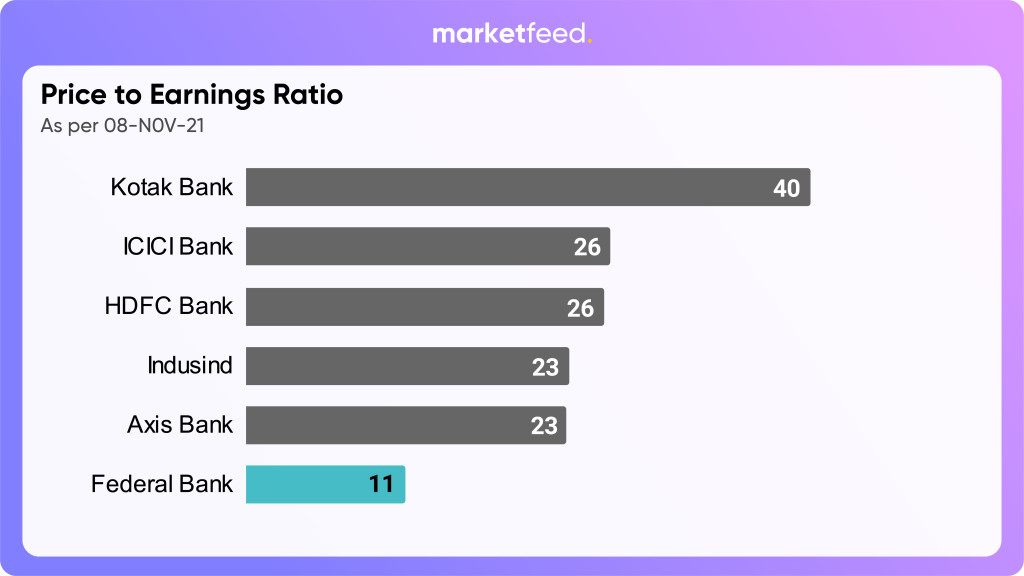

For investors, it is always a key strategy to buy a stock when it is cheaply available. Let us look at one of the valuation ratios— the price to Earnings (PE) ratio.

As we can see, Federal Bank has a very low PE ratio compared to industry leaders. A PE ratio of 11 says that investors are ready to pay Rs 11 for every Rs 1 generated as profit by the company. PE stands at above 20 for every other bank, which makes Federal Bank cheaply available.

Conclusion

Federal Bank is a midcap stock with a market capitalization of Rs ~22,000 crore. We have compared the lender with the top-performing large-cap banks for our analysis. Hence, we can state that the bank has a long way to go in certain metrics.

In the past year, the stock has outperformed the BANKNIFTY index by ~34%. The recent quarter results have beaten all street estimates and various brokerage houses have given a major upside for the stock.

Looking at the financial performance, a decreasing NPA and an increasing CASA will unlock better profitability for the bank.

Federal Bank is a professionally run company with no promoters. The 3-year extension of Mr. Shyam Srinivasan as MD & CEO of the bank by the Reserve Bank of India (RBI) will ensure that current operations and future projects will be given more focus and importance.

Have you added Federal Bank to your portfolio? Let us know in the comment section of the marketfeed mobile app.