Fino Payments Bank launched its three-day initial public offering (IPO) on November 29. The IPO closes in two days. It is inspiring to see such a young company doing an IPO just four years from its incorporation. In this article, we dive into the details surrounding the company and its IPO.

Company Profile – Fino Payments Bank Ltd

Fino Payments Bank Ltd (FPBL) is a fintech company that offers a diverse range of financial products and services. Since its incorporation in 2017, the company has grown its operational presence to cover over 90% of the districts in India as of September 2021. Its main products and services include:

- Current accounts and Savings accounts (CASA)

- Issuance of debit card and related transactions

- Facilitating domestic remittances

- Open banking functionality (through its Application Programming Interface or API)

- Withdrawing and depositing cash via micro-ATM or Aadhaar Enabled Payment System (AePS)

- Cash Management Services (CMS)

FPBL operates an asset-light business model. It relies on fees and commission-based income generated from merchant networks and strategic commercial relationships. The merchants facilitate FPBL in cross-selling its other financial products and services such as third-party gold loans, insurance, bill payments, and recharges. The company’s merchant network is primarily concentrated in Uttar Pradesh, Bihar, and Madhya Pradesh. Nearly 45% of the merchants working with the bank come from these states as of FY21, contributing 43% of its revenue.

Fino Payments also manages a large Business Correspondents (BC) network on behalf of other banks. BCs are retail agents that represent banks and are responsible for delivering banking services at locations other than a bank branch or ATM.

Last year, the Ministry of Electronics & Information Technology ranked Fino Payments Bank third among banks in facilitating digital transactions in India. The company also has the largest network of micro-ATMs in the country.

About the IPO

Fino Payments Bank’s public issue opens on October 29 and closes on November 2. The company has fixed Rs 560-577 per share as the price band for the IPO.

The fresh issue of shares (of the face value of Rs 10 each) aggregates to Rs 300 crore. The offer for sale (OFS) of up to 1.56 crore shares from existing shareholders aggregates to Rs 900.29 crore. Individual investors can bid for a minimum of 25 equity shares (1 lot) and in multiples of 25 shares thereafter. You will need a minimum of Rs 14,425 (at the cut-off price) to apply for this IPO. The maximum number of shares that can be applied by a retail investor is 325 equity shares (13 lots).

FPBL will utilise the net proceeds from the IPO to expand/boost its Tier-1 capital base to meet its future capital requirements. The funds will be used to develop its technology infrastructure, as it looks to expand into new geographies and broaden the suite of services offered. Tier 1 capital consists of shareholders’ equity and retained earnings (disclosed on their financial statements) and is a primary indicator to measure a bank’s financial health. The company will also use the proceeds to meet the expenses in relation to the public offer.

The total promoter in the company will decline from 100% to 75% post the IPO.

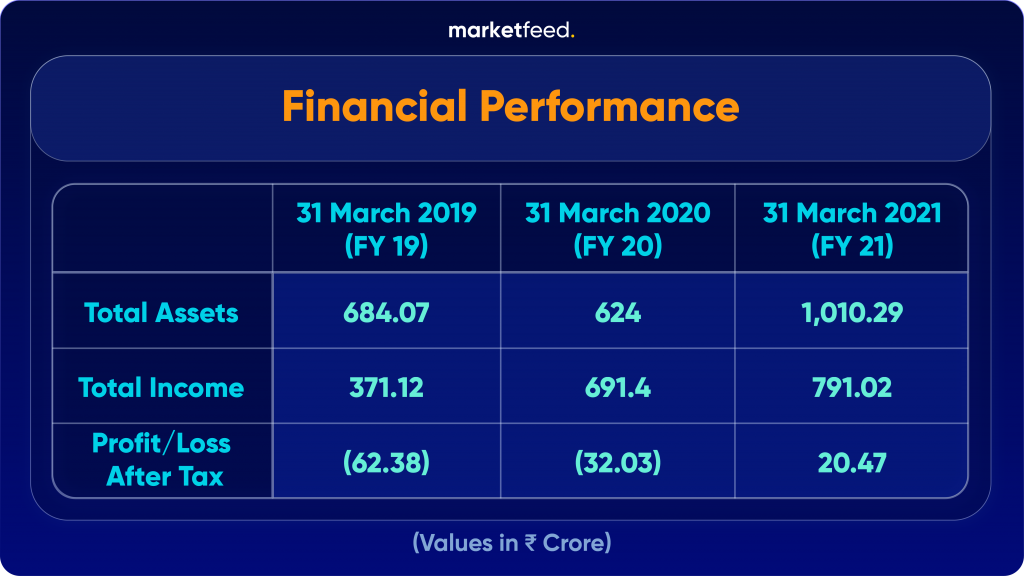

Financial Performance

Fino Payments Bank reported a net profit of Rs 20.4 crore for the year ended March 2021 (FY21), compared to a net loss of Rs 32 crore in the previous year. It was aided by a 14.4% year-on-year (YoY) rise in its total income to Rs 791 crore. The company’s expenses grew 6.5% YoY to Rs 770 crore in FY21. The capital adequacy ratio (CAR) stood at 56.3% in FY21, compared to 61% in FY20. CAR helps make sure that banks have enough capital to protect depositors’ money. Payments banks usually have high capital adequacy since they do not lend from their balance sheets.

In terms of total deposits, Fino Payments Bank ranks fourth amongst its peers at Rs 241 crore (as of FY21). The company registered a debit card base of 23.3 lakh and an annual transaction value of Rs 1,712 crore in FY21. For comparison, Paytm Payments Bank had a card base of 6.4 crore and recorded transactions worth Rs 8,453 crore last fiscal. FPBL generates 95% of its income through fees and commissions.

The company posted negative cash flows of Rs 836.73 crore in FY20 and Rs 322.24 crore in FY21. Cash outflows over extended periods could affect FPBL’s ability to undertake its day-to-day business and implement its growth plans.

Risk Factors

- Fino Payments Bank is heavily dependent on income from fees and commission-based activities. Its financial performance could be severely affected if they are unable to generate income from such activities.

- The company relies extensively on its technology systems/platforms to offer services. Any disruption or failure in these systems could harm its reputation and lead to loss of business.

- A significant portion of FPBL’s merchant network is concentrated in Uttar Pradesh, Bihar, and Madhya Pradesh. Any adverse changes in the conditions affecting these states could harm the overall performance of the firm.

- Payments banks in India are subject to strict regulations and norms. Such firms undergo frequent inspections from authorities such as the RBI. Fino Payment Bank’s operations could be negatively affected if they are unable to comply with such rules.

- FPBL has a limited operating history, making it difficult for prospective investors to assess its potential.

- There are pending litigations against the company and its promoters. HDFC Bank had filed a suit claiming Rs 1.86 crore in damages against FPBL’s subsidiaries. The private bank has alleged certain irregularities against the company in its role as a business correspondent.

IPO Details in a Nutshell

The book-running lead managers to the public issue are Axis Capital, CLSA India, ICICI Securities, and Nomura Financial Advisory & Securities. Fino Payments Bank Ltd had filed the Red Herring Prospectus (RHP) for its IPO earlier this month. You can read it here.

Ahead of the IPO, FPBL was able to raise Rs 539 from anchor investors. The marquee investors include Fidelity, HSBC Global, Pinebridge, Tata MF, Aditya Birla Sun Life MF, and Society Generale.

Conclusion

Currently, Fino Payments Bank is present in 94% of districts in India. The company plans to expand its network of over 7 lakh merchants, as they become outlets for financial transactions through micro ATMs. FPBL offers its remittance and payments services through these micro ATMs, further adding to its fee income. The payments bank is also looking to enter the consumer credit business through partnerships with leading banks and non-bank lenders. Moreover, it has applied for licenses to start offering mutual funds and is seeking permission to buy and sell gold on its digital platform. The lender’s growth depends on the rising digital payment opportunities in India. Thus, one could invest in the company based on its future prospects.

FPBL will be the first payments bank to get listed on the stock exchanges, beating out Paytm. The company became profitable in the fourth quarter of FY20 and has been profitable in the subsequent quarters. However, it faces stiff competition from players such as Paytm, Airtel Payments Bank, India Post Payments Bank, and Jio Payment Bank.

Before applying for the IPO, we will wait to see if the portion reserved for institutional investors gets oversubscribed. The issue was subscribed 51% on the first day of bidding. As always, ensure that you understand the risks associated with the company and come to your own conclusion.

What are your opinions on this IPO? Will you be applying for it? Let us know in the comments section of the marketfeed app.