Here are some of the major updates that could move the markets tomorrow:

Union Budget 2023-24 presented in Parliament

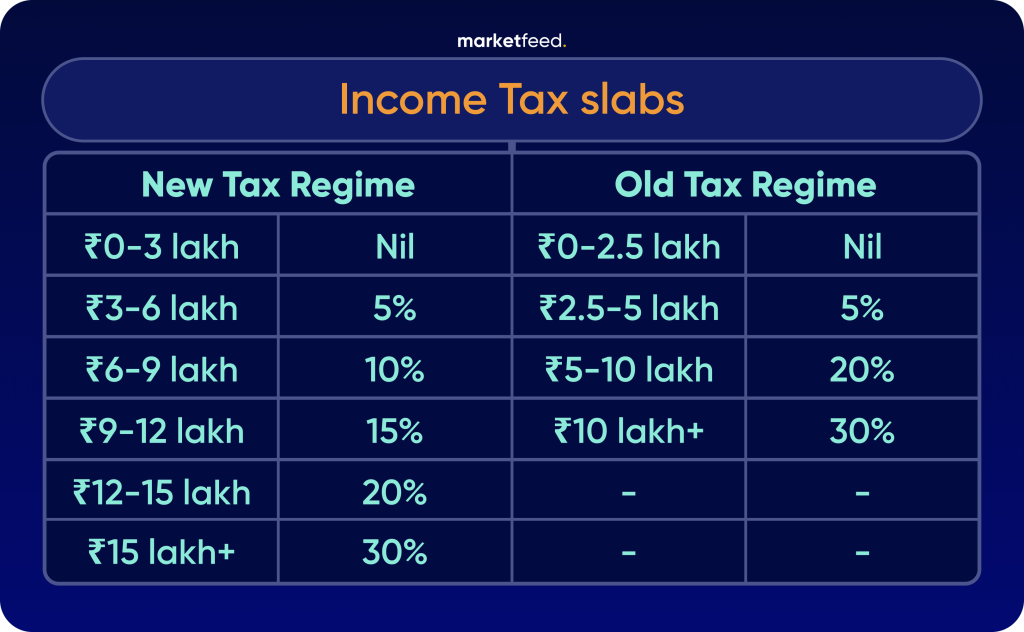

Union Finance Minister Nirmala Sitharaman presented the Union Budget 2023-24 in Parliament today. She announced that there will be no tax on income of up to ₹7 lakh a year (up from ₹5 lakh earlier). The Central government will spend ₹10 lakh crore on long-term capital expenditure (capex) in FY2023-24 to enhance growth potential & job creation and boost private investments. The Finance Ministry allocated ₹2.40 lakh crore to Indian Railways, the largest capital outlay for railways to date.

Read more here.

India’s manufacturing PMI rises to 3-month low in Jan

India’s manufacturing sector fell to a three-month low in January 2023 as production slowed and total output fell. The S&P Global India Manufacturing Purchasing Managers’ Index (PMI) stood at 55.4 in Jan, compared to 57.8 in December. The domestic market was the main source of new business growth as international sales rose only slightly in January.

PMI is a month-on-month calculation, and a value above 50 represents an expansion compared to the previous month.

Read more here.

Total investment by power PSUs to rise nearly 15% to ₹60,805 crore in FY24

The Indian government has proposed to increase total investment by its eight state-owned power companies by about 15%, taking the total investment to ₹60,805 crore for FY24. NHPC witnessed the highest increase in investment to ₹10,857 crore in 2023-24, from a revised estimate of ₹7,128 crore for FY23. Investment by SJVN has been hiked to ₹10,000 crore for FY24, from the revised budget estimates of ₹8,000 crore in FY23.

Read more here.

Powergrid Q3 Results: Net profit rises 10% YoY to ₹3,702 crore

Power Grid Corporation of India reported a 10.5% YoY increase in net profit to ₹3,701.72 crore for the quarter ended December (Q3 FY23). The power company’s revenue from operations grew 7.4% YoY to ₹10,746.4 crore during the same period. EBITDA stood at ₹9,380 crores in Q3, up 9% YoY. The company’s board has declared an interim dividend of ₹5 per share for the current financial year (FY23).

Read more here.

Govt receives bids for 32 mines in 6th round of commercial coal auction

The government has received bids for 32 mines in the technical round of the sixth round of commercial coal auction that had offered 133 coal and lignite mines. A total of 86 bids were received against the 32 coal mines. NTPC Ltd, Jindal Power Ltd, Jindal Steel & Power Ltd, Vedanta Ltd, JSW Steel Ltd, NLC India Ltd, Dalmia Cement, Shree Cement, Ultratech Cement, and Ambuja Cement were among the 56 companies that submitted the bids.

Read more here.

Jubilant FoodWorks Q3 Results: Net profit falls 36% YoY to ₹88 crore

Jubilant FoodWorks reported a 36% YoY decline in net profit to ₹88 crore for the quarter ended December (Q3 FY23). Its revenue from operations rose 10% YoY to ₹1,316 crore during the same period. The company opened 64 new stores in Q3, resulting in a network of 1,814 stores across all brands (Dominos India, Dunkin Donuts). The performance decline was mainly due to high inflation.

Read more here.

Britannia Q3 Results: Net profit jumps 151% YoY to ₹932 crore

Britannia Ltd reported a 151% YoY jump in consolidated net profit to ₹932 crore for the quarter ended December (Q3 FY23). Its revenue from operations rose 16% YoY to ₹4,101 crore during the same period. The net profit included an exceptional gain of ₹359 crore due to a joint venture with Bel SA and the consequent sale of a 49% equity stake in its subsidiary (Britannia Dairy).

Read more here.

Auto sales data for Jan 2022: Highlights

Maruti Suzuki India posted a 12% year-on-year (YoY) increase in wholesale sales to 1.72 lakh units in Jan 2023. Sales of its mini and compact vehicle segment rose 10.2% YoY to 99,286 units. Exports fell 3% YoY to 17,393 units.

Tata Motors Ltd registered an 18% YoY increase in passenger vehicle sales to 48,289 units in Jan. The automaker’s commercial vehicle sales fell 7% YoY to 32,780 units.

Mahindra & Mahindra’s total passenger vehicle segment posted total sales of 33,040 units in Jan, an increase of 65% YoY. M&M’s tractor sales rose 28% YoY to 28,926 units.

TVS Motor Company’s total sales stood at 2.75 lakh units in Jan, up 3% YoY. Meanwhile, Bajaj Auto’s sales fell 21% YoY to 2.85 lakh units.

Read more here.